Finance

Invoicing in your Database for your Service Business

Databases can serve many complementary or auxiliary functions beyond storing customer information. One of the most valuable extensions is integrating invoice generation into your existing database system for service-oriented businesses. Almost every service business requires billing and invoice generation. This includes contractors, mechanics, repair personnel, technicians, handymen, and more. In these roles, it is essential not only to track your customers but also to track materials, labor, taxes, surcharges, and all related billing components.

Why Generate Invoices Using a Database?

For businesses in service industries, a database is already a hub of critical information. Adding invoicing functionality to this database is a natural step. Much of the information needed to generate invoices already resides in your system. For example, a customer database will contain contact details such as name, address, and phone number. With integrated invoicing, this information can automatically populate the invoice, saving time and reducing errors.

Databases also maintain structured organization of customer data. Invoicing features can leverage this structure to assign invoices automatically to the correct customers, creating a seamless workflow. With a properly structured system, you can quickly access a customer’s billing history, past services, and outstanding balances. This is a significant improvement over paper-based systems, which can be disorganized and prone to error.

Automated invoicing reduces the risk of human error, ensures that invoices comply with regulations, and provides a professional appearance to your customers. It also simplifies reporting, accounting, and audit processes. When customer data, job details, and invoice generation are all stored in one database, your business operates more efficiently and professionally.

Commercial Invoice Components and Templates

When selecting a database system with invoicing features, ensure that the invoices contain all necessary information. Key components often include invoice number, date of service, labor and material charges, and taxes. Beyond these, there may be other components depending on your business needs. These may include:

- Discounts, including percentages or flat-rate deductions

- Provincial, state, or harmonized taxes

- Environmental fees or government-mandated surcharges

- Payment terms and due dates

- Outstanding balances and partial payments

- Customer contact information

- Company logo, branding, and job notes

- Warranties or guarantees on work performed

Taxes and fees may differ by jurisdiction or by type of service, and not all line items may be taxable. For example, some regions do not tax labor time. Make sure your invoicing system can accommodate these rules and automatically apply them correctly.

Discounts can be complex, ranging from dollar-based discounts to free labor, free parts, or loyalty rewards. Your system should be capable of calculating these automatically. This ensures consistency, accuracy, and reduces administrative time.

Your invoice should also reflect payment methods, previous payments, and any outstanding balances. For customers on installment plans, the system should be able to generate reports highlighting upcoming payments. This helps your staff follow up proactively on unpaid invoices and maintain healthy cash flow.

Finally, your invoices may include additional business-specific information such as warranty details, notes about the job, or custom fields for internal tracking. A robust invoicing system, like the one offered by Tracker Ten, allows you to customize invoice templates to match your exact requirements. Contact us for assistance with custom templates.

Exporting Invoice Data

If your business uses accounting software like QuickBooks, your database should support exporting invoice data. This is crucial for:

- Generating tax reports and preparing for audits

- Tracking sales over a specific period

- Reconciling accounts with bank statements

- Analyzing revenue streams by customer, service, or region

- Integrating data into other reporting tools or dashboards

Export functionality should support common formats such as CSV, Excel, or XML, ensuring that your data can be easily imported into other software systems or shared with accountants and auditors.

Estimates vs Invoices

In addition to invoices, service businesses often generate written estimates. While estimates resemble invoices in structure, there are key differences:

- Materials listed on estimates should not be automatically deducted from inventory.

- Estimates should be distinguished from completed sales in reporting.

- Estimates provide a clear expectation for clients without affecting financial records.

- Some databases allow estimates to convert into invoices once the job is approved.

A well-structured system should track both estimates and invoices, ensuring accurate reporting and seamless transition from proposal to billing. This distinction also helps with budgeting and project forecasting.

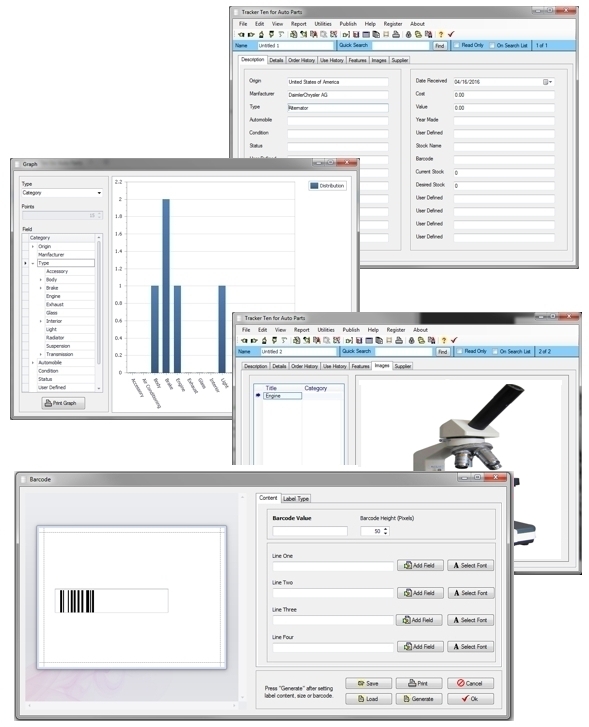

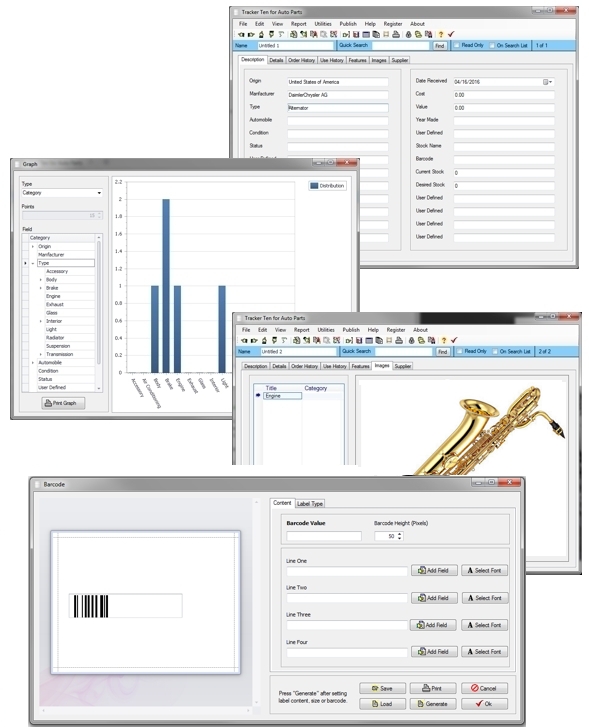

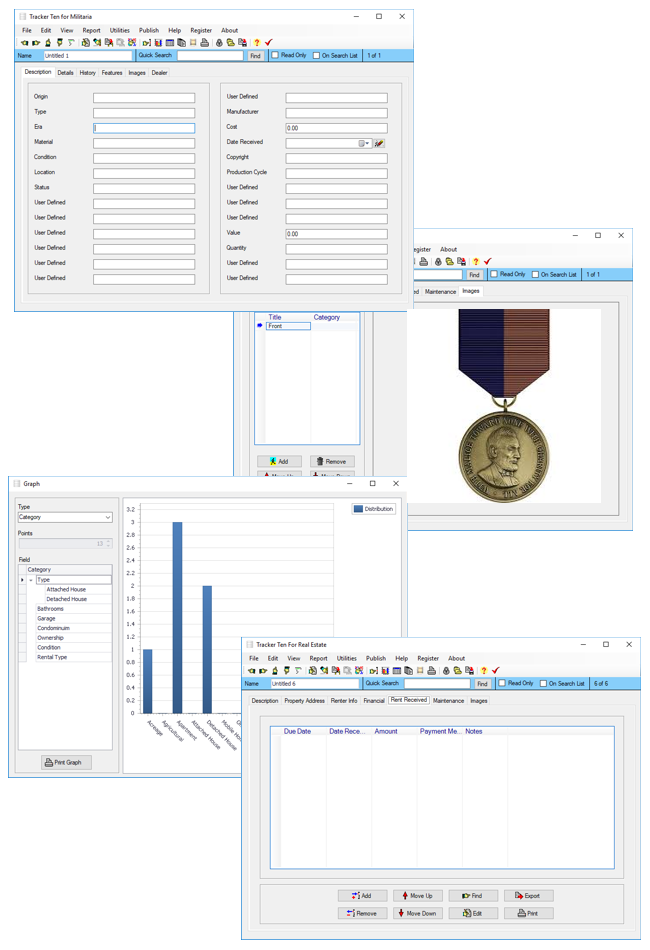

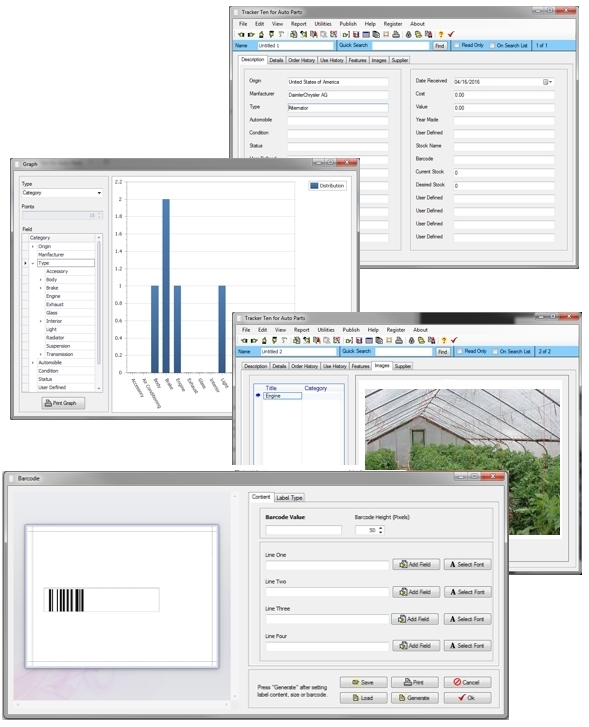

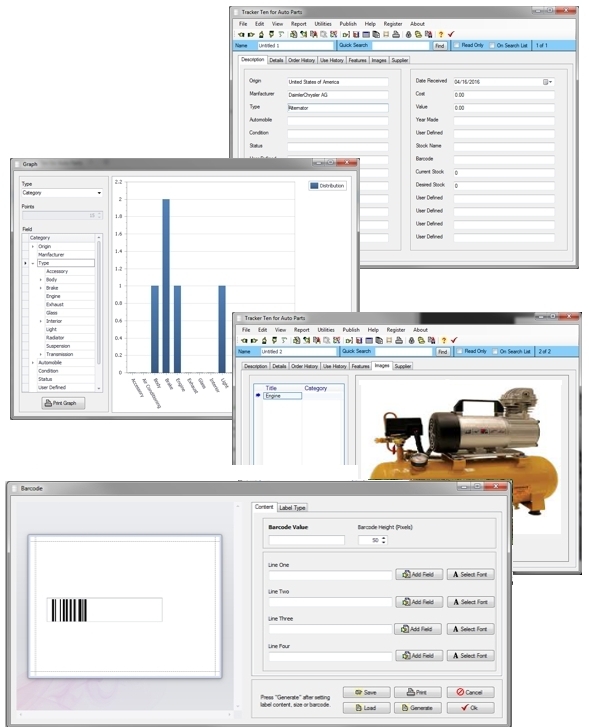

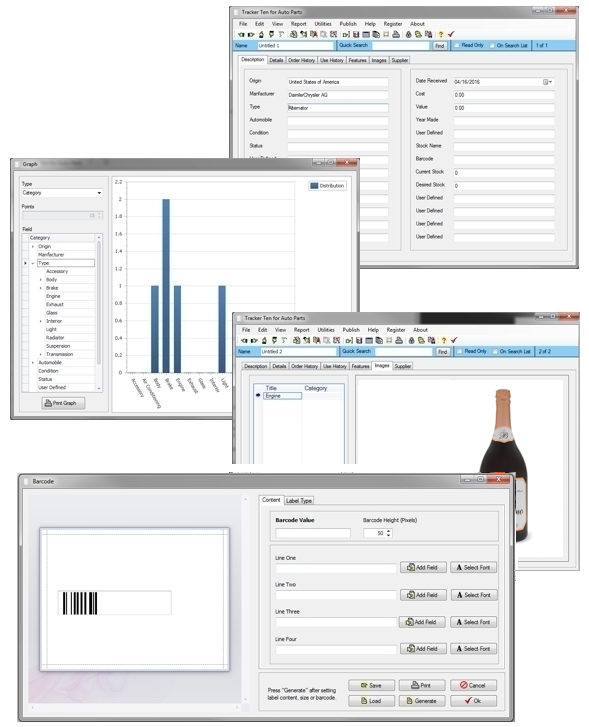

Tracker Ten Invoicing Software

Tracker Ten offers Windows desktop database products with built-in invoicing capabilities, designed for service businesses. Key features include:

- Tracker Ten for Repair Jobs – Ideal for service providers who repair customer equipment, allowing detailed tracking of labor, parts, and materials.

- Tracker Ten for Contractors – Enables contractors to generate invoices, manage multiple projects, and apply varying taxes or surcharges.

- Tracker Ten for Invoicing – General-purpose invoicing system suitable for all service businesses, integrating labor, materials, taxes, and custom branding.

These systems allow users to enter labor, materials, and supplies directly into invoices, apply relevant taxes and discounts, include logos and contact information, and manage multiple payment methods. Integration with your database ensures that customer history, job notes, and outstanding balances are always up-to-date.

Advanced Features of Database-Integrated Invoicing

Modern database systems with invoicing capabilities offer several advanced features that simplify operations and improve business intelligence:

- Recurring invoices: Automatically generate invoices for subscription-based or repeat services.

- Batch processing: Create multiple invoices simultaneously for efficiency.

- Custom fields: Add business-specific information such as job notes, warranty periods, or special instructions.

- Payment reminders: Automated alerts for overdue invoices improve cash flow.

- Integration with payment gateways: Allow customers to pay online directly from the invoice.

- Reporting dashboards: Generate insights on sales trends, outstanding balances, and customer payment behavior.

By leveraging these features, service businesses can reduce administrative workload, improve cash flow, and gain insights into operational efficiency.

Best Practices for Database Invoicing

To maximize the benefits of database-integrated invoicing, consider implementing the following best practices:

- Ensure customer data is complete and accurate.

- Keep tax codes, surcharges, and discounts up-to-date according to local regulations.

- Customize invoice templates to match your brand identity.

- Use automated reminders for overdue invoices.

- Track invoice history and payment status in real-time.

- Generate reports for forecasting, budgeting, and audit purposes.

- Regularly back up database and invoice data to prevent data loss.

- Train staff on software features and invoicing procedures.

Implementing these practices ensures invoices are accurate, compliant, and professional, which enhances customer satisfaction and reduces administrative errors.

Security and Compliance

When dealing with customer data and financial information, security and compliance are paramount. Ensure your database and invoicing system support:

- Data encryption for sensitive information

- Secure login and access control for staff

- Audit trails for invoice modifications

- Compliance with GDPR, PCI DSS, and local financial regulations

- Regular system backups

- Secure export and sharing of invoice data

By prioritizing security, your business can prevent data breaches, protect customer trust, and maintain regulatory compliance.

Conclusion

Integrating invoicing within your database provides significant advantages for service businesses. It improves efficiency, reduces errors, simplifies reporting, and enhances customer satisfaction. With solutions like Tracker Ten, businesses can generate invoices, track payments, manage estimates, and maintain compliance, all within a single system. Customizable templates, automated reminders, and advanced reporting features ensure your invoicing process is professional, accurate, and efficient.

By adopting database-integrated invoicing, service businesses can streamline operations, improve cash flow, and focus on delivering exceptional service to their customers.

Looking for windows database software? Try Tracker Ten

- PREVIOUS Club and Community People Tracking Database Software Friday, April 7, 2023

- NextInvoicing and Tracking Software for Contractors Saturday, April 1, 2023