Business

Business Invoices

Business invoicing is a critical process for any company that offers products or services to customers. Invoices serve as formal requests for payment and act as legal documents detailing the transaction between a buyer and a seller. They provide transparency, help maintain accurate records, and facilitate proper financial management. Invoicing can be done manually for small businesses or automated using accounting software for larger organizations with more complex operations.

Proper invoicing ensures timely payments, reduces the risk of disputes, and helps businesses maintain a steady cash flow. In addition, invoices are often used for tax reporting, financial auditing, and record-keeping purposes. The process of invoicing, when well-managed, reflects professionalism and builds trust with customers and clients.

What to Include on an Invoice

An invoice is more than just a bill; it is a detailed document outlining the specifics of a transaction. Including all necessary details ensures clarity, reduces disputes, and facilitates smooth payments. Here are the essential elements that should be included on every invoice:

Seller information: Include the name, address, and contact details of the seller or business issuing the invoice. This establishes the origin of the invoice and provides the buyer with a point of contact for questions or concerns.

Buyer information: Include the name, address, and contact details of the buyer or client. This ensures the invoice is directed to the correct recipient and provides documentation for both parties.

Invoice number: A unique identification number helps track invoices and maintain organized records. Sequential numbering is recommended to prevent duplication and simplify auditing.

Invoice date: The date the invoice is issued helps establish timelines for payment and ensures proper documentation of the transaction.

Payment terms: Specify the terms of payment, including due dates, acceptable payment methods, and any applicable late fees or penalties. This helps set clear expectations and reduces potential delays in payment.

Itemized list of goods or services: Provide a detailed description of the products or services rendered, including quantity, unit price, and any applicable taxes or discounts. This transparency helps the buyer verify the accuracy of the charges.

Total amount due: Clearly display the total amount owed, including taxes, fees, and discounts. Highlighting this amount ensures the buyer understands the final payment due.

Payment instructions: Provide details on how payment should be made, whether via bank transfer, credit card, online payment portal, or mailing address for checks. Clear instructions prevent confusion and delays.

Terms and conditions: Include relevant terms, such as warranties, guarantees, or return policies, and any legal disclaimers. This ensures both parties are aware of their rights and obligations.

By including all these elements, businesses ensure clarity, facilitate timely payments, and maintain accurate records for accounting and auditing purposes. An accurate invoice reflects professionalism and helps prevent disputes between buyers and sellers.

Invoice Payment Terms

Invoice payment terms are the conditions under which payment is expected. These terms provide structure to the transaction and ensure both parties are clear on expectations. Properly defined payment terms are essential to maintaining healthy cash flow and minimizing late payments.

Common invoice payment terms include:

Due date: The date by which the payment should be made. This can be expressed as "Net 30," "Net 60," or any other agreed-upon timeframe from the invoice date.

Payment method: Specify acceptable payment methods, such as checks, bank transfers, credit cards, or online payment platforms.

Late payment fees: Outline penalties or interest charges for late payments, encouraging prompt payment and protecting the business from cash flow issues.

Discounts: Offer incentives for early payment, such as a 2% discount if paid within 10 days, which can improve cash flow and customer loyalty.

Payment schedule: For large or ongoing projects, outline installment payments, milestone-based payments, or recurring billing schedules.

Payment confirmation: Define how payments will be confirmed, such as through email receipts or acknowledgment letters, to maintain transparency and record-keeping.

Clearly defined payment terms reduce misunderstandings, encourage timely payments, and provide a framework for resolving disputes. Businesses should communicate these terms upfront and ensure customers are aware of them before the transaction is completed.

Late Invoice Payments

Late payments are a common challenge for businesses and can significantly impact cash flow. Effective management of overdue invoices is essential to maintaining financial stability. Here are strategies to address late payments:

Send reminders: Send polite reminders immediately after a payment is overdue, typically a few days past the due date, to prompt the customer to act.

Follow up with phone calls: If reminders are ignored, contacting the customer directly helps address potential issues or concerns preventing payment.

Negotiate payment plans: Offer partial payments over time if the customer cannot pay the full amount at once, maintaining a positive relationship while recovering funds.

Charge interest or late fees: Apply agreed-upon fees for overdue payments, incentivizing timely payment and compensating for delays.

Seek legal action: As a last resort, businesses may pursue collection agencies, legal demand letters, or court action to recover unpaid funds.

Proactive follow-ups, clear communication of payment terms, and consistent enforcement of late fees can significantly reduce late payments and strengthen financial management.

Electronic Invoicing

Electronic invoicing, or e-invoicing, is the process of creating, sending, and receiving invoices digitally. E-invoicing streamlines the payment process, reduces errors, and improves overall efficiency. Many modern businesses adopt e-invoicing to manage high volumes of transactions.

Benefits of e-invoicing include:

Cost savings: Eliminates printing, postage, and manual processing costs.

Faster processing: Digital invoices reach the recipient instantly, accelerating payment cycles.

Reduced errors: Automated data entry reduces mistakes common with paper invoices.

Improved visibility: Track invoice status, payment history, and outstanding balances in real time.

Improved cash flow: Faster processing and immediate delivery often result in quicker payments.

Considerations for e-invoicing:

Security: Implement encryption, secure login, and anti-fraud measures to protect sensitive data.

Compatibility: Ensure the e-invoicing system integrates with both the business's and customer's accounting software.

Legal requirements: Comply with regulations on electronic signatures, invoicing formats, and record retention.

Data privacy: Safeguard customer and transaction information to prevent breaches and comply with privacy laws.

E-invoicing not only improves operational efficiency but also enhances professionalism and reduces administrative overhead.

Invoicing Legal Requirements

Legal requirements for invoices vary by jurisdiction, industry, and transaction type. However, most invoices should include the following core elements to ensure compliance:

Invoice date: Establishes when the invoice was issued.

Unique invoice number: Facilitates tracking and auditing.

Seller's information: Name, address, and tax identification number.

Buyer's information: Name, address, and relevant tax details.

Description of goods or services: Detailed list including quantities, prices, and applicable taxes or fees.

Payment terms: Due date, payment methods, and any late fees or early payment discounts.

Tax information: Applicable tax rates, amounts, and any legal tax identification numbers.

Currency: Indicates the currency of payment.

Total amount due: Summarizes the final payable amount.

Additional legal requirements may include specific invoice layouts, mandatory disclosures, or inclusion of government-mandated identification numbers, depending on jurisdiction. Compliance ensures invoices are recognized legally and minimizes disputes with authorities or clients.

Invoice vs Contract

Invoices and contracts are distinct but complementary documents in business transactions. Understanding their differences is crucial for proper financial and legal management.

Purpose: An invoice requests payment for completed goods or services, while a contract establishes terms and obligations before work begins.

Timing: Invoices are issued after the service or product is delivered; contracts are signed prior to starting work.

Content: Invoices focus on payment details and itemized charges, whereas contracts include scope of work, deliverables, timelines, and legal terms.

Legally binding: Invoices are not inherently legally binding beyond payment obligations, while contracts create enforceable obligations for both parties.

Enforceability: Invoices can be enforced through collections for payment; contracts can enforce both delivery and payment terms.

Receipts vs Invoices

Receipts and invoices are often confused, but they serve different purposes. Receipts provide proof of payment; invoices request payment.

Receipts typically include:

Seller and buyer information

Date and time of payment

Payment method

Description of goods/services

Total payment

Transaction number

Invoices typically include:

Seller and buyer information

Date of invoice

Itemized list of goods/services

Total amount due

Payment terms

Invoice number

Understanding these differences helps businesses maintain accurate financial records and ensures clear communication with customers.

Getting Paid

Accurate and timely invoicing is essential to ensure businesses receive payments promptly. Monitoring outstanding invoices, sending reminders, and following up on late payments help maintain a healthy cash flow. Businesses should also train staff on invoicing best practices and ensure proper documentation for auditing and accounting purposes.

Invoicing Software

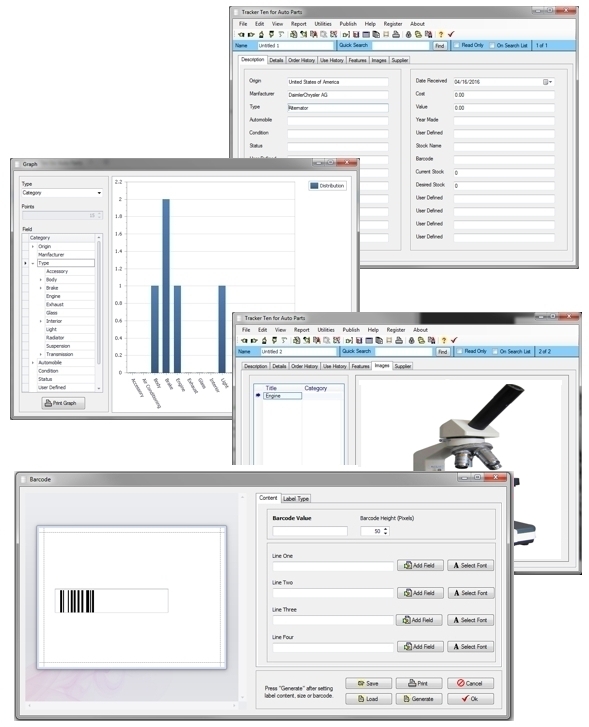

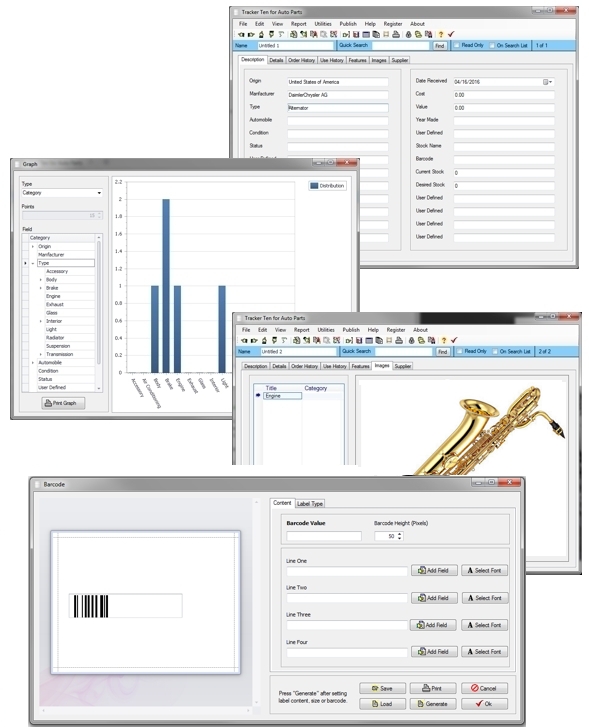

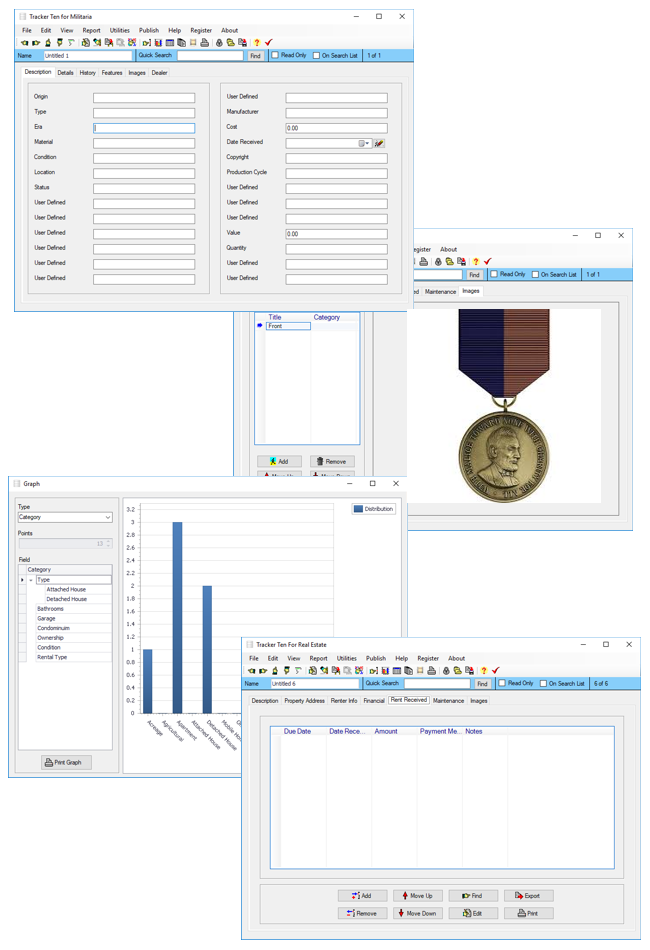

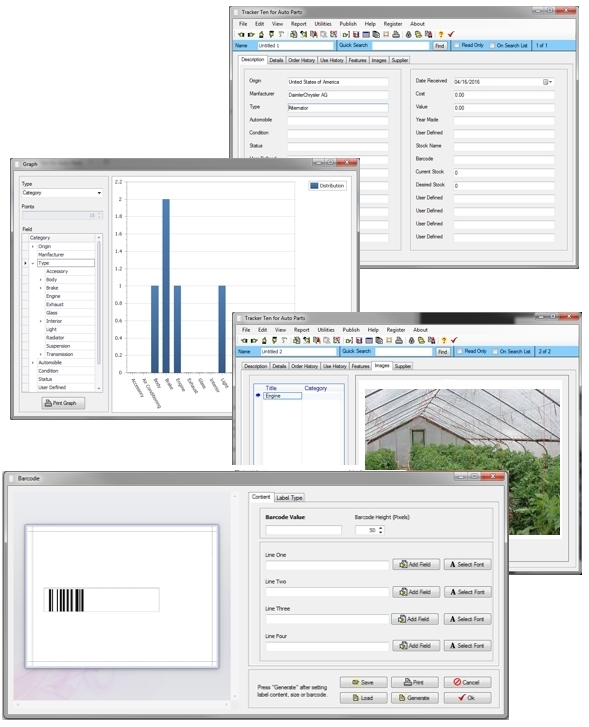

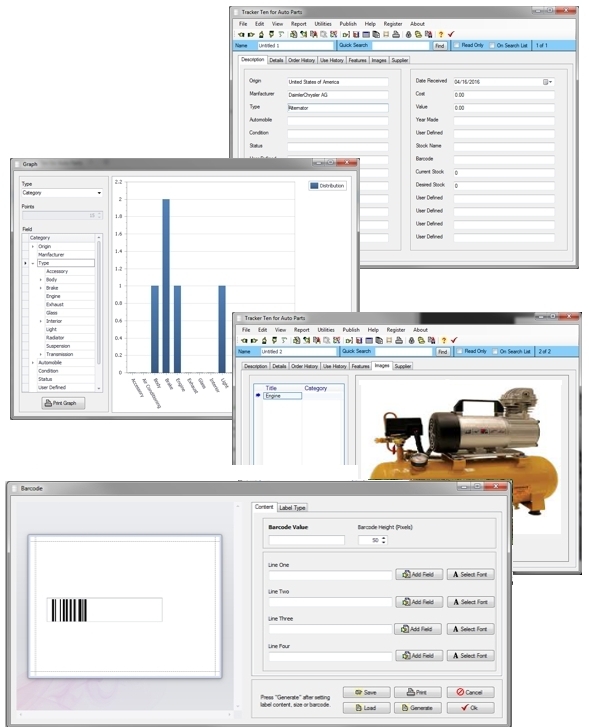

Modern businesses often use software to streamline invoicing, reduce errors, and automate payment reminders. Tracker Ten offers several products designed for specific industries, including:

These software solutions automate invoice creation, tracking, reminders, and reporting, enabling businesses to focus on operations while ensuring financial accuracy.

Conclusion

Effective invoicing is fundamental to business success. Accurate, timely, and well-documented invoices improve cash flow, reduce disputes, and ensure compliance with legal requirements. By understanding the differences between invoices, receipts, and contracts, implementing clear payment terms, and leveraging modern invoicing software, businesses can streamline operations, maintain financial stability, and build stronger relationships with customers. Proper invoicing reflects professionalism, fosters trust, and supports sustainable growth for any business.

Looking for windows database software? Try Tracker Ten

- PREVIOUS Databases for Small Projects Sunday, November 3, 2024

- NextWine Collecting Friday, October 18, 2024